Nsutaman Rural Bank offers three main products and they are

- Savings Product

- Loan Products

- Investment Products

1. SAVINGS PRODUCTS

Savings products are an interest-bearing deposit account held. Though these accounts typically pay a modest interest rate, their safety and reliability make them a great option for parking cash you want available for short-term or medium-term needs.The following are the various Savings Products

A. SAVINGS ACCOUNT

This is an interest-bearing account designed to encourage traders and individuals to save and earn interest on the cash deposited in the account.

Features:

- Minimum operating balance of GH10.00

- Customer makes deposits on any working day

- SMS alert services provided on all deposits and withdrawal transactions

- Interest bearing account

- Interest calculated daily and applied monthly

- Issuance of withdrawal booklets

- No maintenance charges

- Minimum age is 18 years

Benefits

The benefits include the following:

- Save more, Earn more

- Attractive interest on deposits

- Access to your account statement at any time

- Easy access to money

- Opportunity to save towards the future

- Low initial deposit

- Acquisition of loans

B. • SUSU SAVINGS ACCOUNT

This is a normal Susu deposit account meant for petty traders who would want to save and withdraw their balances at the end of every month.

Features:

- Customer makes deposit with any amount

- Daily contribution

- Door step banking provided by dedicated Sales Executives

- Three-month continuous savings without withdrawal qualifies customer for a loan

- Irregular withdrawal attracts a fee of GH 3.00 on account

- SMS alert services provided on all transactions

Benefits

The benefits include the following:

- Savings at your comfort and door steps

- Your money is kept safe

- Loan can be arranged very easy

C. CURRENT ACCOUNTS

A deposit product that provides easy access to funds. This account type is normally termed as business account that is recommended for those in business activities. It is a cheque-bearing account meant for businessmen/women, salaried customers, groups, companies, and individuals who frequently need money for their business operations. Withdrawals on credit balances can be made as frequently as possible. Other benefits include overdrafts and loans.

Features

- Minimum operating balance should be GH¢50

- Issuance of cheques books

- Free business advice

- Free cash collection at your request

- Commission on Turnover (COT)

- Unlimited withdrawals

Benefits

- SMS alert services provided on all deposits and withdrawals

- Easy and unlimited access to your funds

- Unlimited withdrawals

- Access to new business ideas and contacts

- You can keep an eye on your account

- Help you grow your business

- Issuance of Cheque book

- Easy access to loans and over draft facilities

- Third party withdrawal

D. FIXED DEPOSITS

This is an investment account where money is deposited for a fixed period and the interest rate does not change. A Fixed Deposit offers higher interest rates than ordinary savings accounts.

Features:

- Amount of investment is determined by client

- Period of investment is determined by client

- Interest rate which is negotiable is determined upfront

- No commission on turnover (COT)

- No account maintenance fee

- Must be an account holder

- Higher interest rate

- Minimum deposit of GHC1,000

- Certificate of deposit will be issued

Benefits

- High returns on your money

- Ability to earn more

- You can have instant access to your money

- Help you grow your business

- Access to funds on demand

- Negotiable interest rate

E• SALARY ACCOUNT

It’s a current account for all salary customers.

Features:

- Open to all salary workers

- Eligible to apply for salary loan or salary advance

- Cheque book provided.

- SMS alert services provided on all deposits and withdrawals

2. LOAN PRODUCTS

The bank has tailor-made loan products designed to suit its numerous customer needs. These include the following:

Read through the various loan products available for you.

A. SUSU LOAN

This product is targeted to petty traders, artisans, taxi drivers, etc etc.

Features

- Regular Susu contributor

- Double the size of Susu contribution as loan

- Interest rate- Fixed

- Account operation should be 3 months’ minimum

- Must be an account holder

B. SME LOANS

A product designed for Small and Medium Scale Enterprises (SMEs)

Features

- Have an account with the bank

- Demonstrate outstanding credit turnover

- Customers should demonstrate commitment to the business

- Personal guarantee or any other collateral

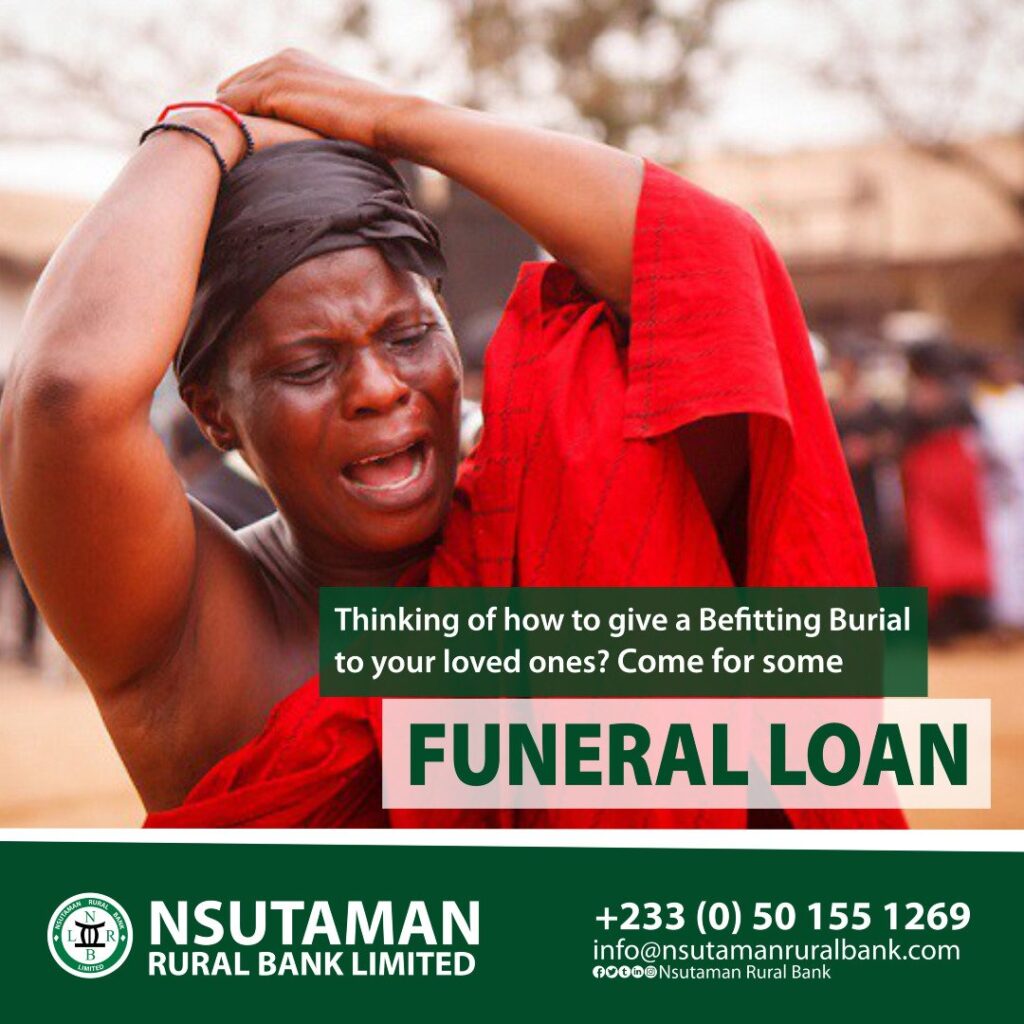

C. FUNERAL LOAN

It is a short-term facility given to our cherished customers to give their loved ones a befitting funeral.

Features

- Applicant must have an account with the bank

- Application letter from the applicant

- Applicant should be accompanied by two family members

- Personal guarantors are required

- There should be evidence of the said funeral

- Maximum duration of one month

D. SALARY LOAN

These loans are available to all account holders who process a regular income from their employers. Ideal for those who earn a regular salary income through their employment. The loan can be used for Schools Fees, Medical Bills, Purchase of household items, Spare parts etc.

Features:

- Unparalleled and competitive interest rate

- Accessible to virtually any purpose

- Fixed interest rate and monthly deductions

- Loan tenure between 12 months and 36 months

- Have an account with at least one (1) month salary credit

E. MICROFINANCE LOAN (GROUP)

A group savings and loans scheme designed to encourage small and micro unit enterprises to acquire loan to expand their businesses as well to encourage them to save.

Features

- Formation of groups

- Frequent visitation by field officers

- Free education on business issues

- Group mutual guarantee system

- The group must have a minimum membership of four (4) and a maximum of ten (10)

- The group must have at least three leaders (Chairman, Secretary and Treasurer)

F• SALARY ADVANCE

This is one (1) month overdraft facility granted to an employee who collects his/her salary through the bank. A commission of 10% shall be charged on amount granted. Repayment shall be made within or at the end of the month upon receipt of applicant’s salary. A customer can enjoy this facility even if the customer has been granted a loan facility which is being repaid.

G• AGRICULTURE LOAN (GROUP)

A group loans scheme designed to encourage farmers to acquire loan to improve their agricultural activities.

- Formation of groups

- Frequent visitation by field officers

- Free education on business issues

- Group mutual guarantee system

- The group must have a minimum membership of five (5) and a maximum of ten (10)

- The group must have at least three leaders (Chairman, Secretary and treasurer)

- The group members must be engaged in agricultural activities.

H• VILLAGE SAINGS AND LOANS ASSOCIATION.

A group savings and loans scheme designed to encourage farmers to acquire loan to improve their agricultural activities.

- Formation of groups

- Frequent visitation by field officers

- Free education on business issues

- Group mutual guarantee system

- The group must have a minimum membership of five (5)

- The group must have at least three leaders (Chairman, Secretary and treasurer)

- The group members must be engaged in agricultural activities.

3. INVESTMENT PRODUCTS

A. SHARES

A long term investment which is open to all Ghanaians, and with a minimum of GHc15.00 one qualifies to become a shareholder and enjoys all benefits thereof.

B• Me Ba Daakye

A long term investment which is open to every customer who wants to invest on behalf of his/her child below 18 years towards a future goal such as payment of school fees. With a minimum of GHc10.00 one qualifies to open this account and enjoys all benefits thereof.